philadelphia transfer tax regulations

567 approved June 5 1985 and Bill No. Pennsylvania realty transfer tax is imposed at a rate of 1 percent on the value of real estate including contracted-for improvements to property transferred by deed instrument long-term lease or other writing.

Philadelphia Wage Tax Decreases On July 1 Department Of Revenue City Of Philadelphia

32833292 unless otherwise.

. Philadelphias new ordinance seeks to close the loophole for 8911 transactions. Philadelphia transfer tax regulations. 1 There are business economic and tax reasons for entities holding real estate to do business as corporations or associations.

2 Under Federal State and City laws corporations and associations are entities separate from their members partners. Both grantor and grantee are held jointly and severally liable for. Department of Commerce Division of Aviation Regs.

The Pennsylvania Inheritance Tax of 45 applies to transfers to children at death and includes all gifts made within one year of the date of death. Philadelphia transfer tax regulations. The provisions of this Chapter 91 issued under The Fiscal Code 72 P.

If the house was transferred properly into your name 2 years ago it will not be subject to the Pennsylvania Inheritance Tax. It has changed the ownership interest that will trigger the transfer tax from 90 to 75 with a six year waiting period. City of philadelphia real estate transfer tax regulations Length.

Previously a real estate company owed Philadelphia transfer tax upon a 90 or more change of ownership within a three-year period. This transfer tax is traditionally split between the buyer and the seller with each party paying half and becomes payable when the property deed or another document showing ownership is filed with the Record of Deeds. Recorded in September 2020.

Before july 1 2017 if a real. Department of Commerce Division of Aviation. 1 A transfer for no or nominal actual consideration to a trustee of a living trust from the settlor of the living trust is exempt from tax.

City of philadelphia real estate transfer tax regulations Author. The gross receipts portion of the tax remains 1415. PHL-Revised Rates and Charges Regulation Filing.

When a deed is recorded the transfer tax will be paid on the sale price. Department of Revenue Regs4-24-17pdf. 1 1867.

Following a legislated schedule for reductions the rate of the net income portion of the Business Income and Receipts Tax is reduced to 630 for Tax Year 2018. 489 rows Advertisement of Proposed Regulations-Real Estate Transfer Tax Regulations-Section 201- Imposition of Tax on Documents. Effective immediately the Philadelphia Realty Transfer tax will not have to paid on the Office of Property Assessment OPA assessed value.

This link will take you to a sales tax table with an 800. All businesses are required to have a Business Income and Receipts Tax Account Number. This property is exempt from any relevant local or special taxations.

Scheduled reductions to birt continue for tax year 2018. Effective december 15 2007 the pennsylvania department of revenue department amended its realty transfer tax regulations. Ad Download Or Email Form 82-127 More Fillable Forms Register and Subscribe Now.

How is Philadelphia transfer tax calculated. Philadelphia Code 19-1405 Under the new provision a 75 change in ownership will be deemed to have occurred if within six years of one or more prior transfers. Scheduled reductions to BIRT continue for Tax Year 2018.

Philadelphia beginning July 1 2017 will begin to tax transfers of interests in real estate entities based on the selling price of the entity rather than. 8 2016 the philadelphia city council unanimously passed bill no. The Council of the City of Philadelphia finds that.

Ad Download Or Email Form 82-127 More Fillable Forms Register and Subscribe Now. 1259 approved June 11 1987 These regulations have been. Read City of philadelphia real estate transfer tax regulations by MitchForehand4635 on Issuu and browse thousands of other publications on our plat.

The city of Philadelphia has an 800 percent sales tax rate which is made up of 600 percent Pennsylvania state sales tax and 200 percent Philadelphia County sales tax. REAL ESTATE TRANSFER TAX REGULATIONS Preface The Philadelphia Realty Transfer Tax was imposed by Ordinance of City Council approved 1952 codified as Chapter 19-1400 amended by Bill No. 2 A transfer for no or nominal actual consideration from the trustee of a living trust after the death of the settlor of the trust to a beneficiary named or identified as a member of a class of beneficiaries in the trust instrument.

The Department of Revenue still reserves the right to audit any transaction that they. And The Realty Transfer Tax Act 72 P. For billboards and large signs not connected to an individual business contact the Department of Licenses and Inspections Outdoor Advertising Sign Face License.

Philadelphia Realty Transfer Tax. Effective October 1 2018 the transfer tax for the city of Philadelphia is 3278 with an additional state of Pennsylvania tax of 1 for a total of 4278. Effective July 1 2017 a real estate company is treated as an acquired real estate company and owes Philadelphia transfer tax upon a 75 or more change of ownership in the company within a six-year period.

Tax Hear about how real estate transactions are taxed for transfer tax purposes including the recent Philadelphia changes. Get details and regulations for the Philadelphia Realty Transfer Tax rate. This transfer tax is traditionally split between the buyer and the seller with each party paying half and becomes payable when the property deed or another document showing ownership is filed with the Record of Deeds.

Effective October 1 2018 the transfer tax for the city of Philadelphia is 3278 with an additional state of Pennsylvania tax of 1 for a total of 4278.

Log In To The Philadelphia Tax Center Today Department Of Revenue City Of Philadelphia

Pennsylvania Real Estate Transfer Taxes An In Depth Guide

Is Your Real Estate Transaction Subject To Philadelphia Real Estate Transfer Tax Legal Insights Real Estate Law High Swartz Llp

Birt And Npt Philly Business Taxes Explained Department Of Revenue City Of Philadelphia

Philadelphia Revises Realty Transfer Tax Treatment Of Acquired Real Estate Companies

How Much Does It Cost To Build A House In Philadelphia Home Builder Digest

I M Moving My Business To Philadelphia What Do I Need To Know Larsson Scheuritzel P C

Philadelphia Revises Realty Transfer Tax Treatment Of Acquired Real Estate Companies

Inherited A House Here S What You Need To Know About City Taxes And Water Charges Department Of Revenue City Of Philadelphia

Philadelphia Revises Realty Transfer Tax Treatment Of Acquired Real Estate Companies

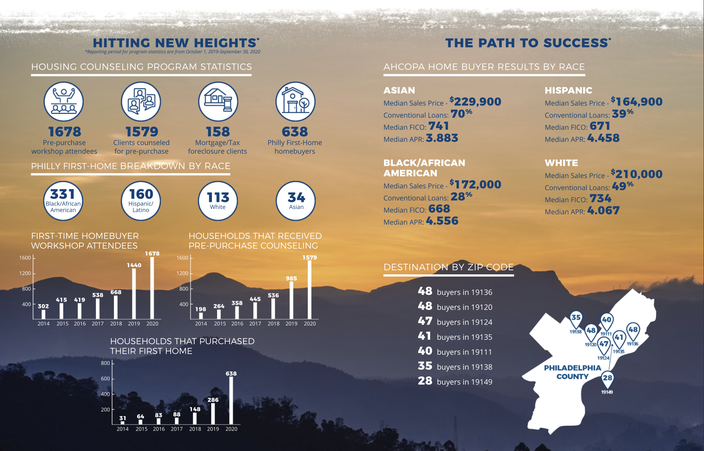

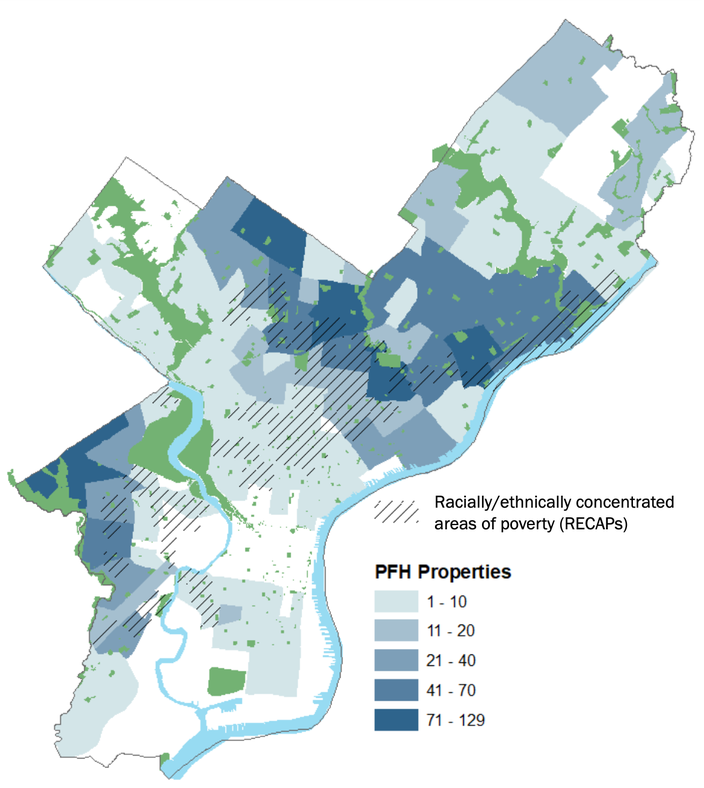

Philadelphia Real Estate Market Crunched By Low Home Supply And Price Inflation Will See The Return Of 10 000 Grants For First Time Buyers Phillyvoice

Pennsylvania Property Tax H R Block

Philadelphia Wage And Earnings Taxes Decrease On July 1 Department Of Revenue City Of Philadelphia

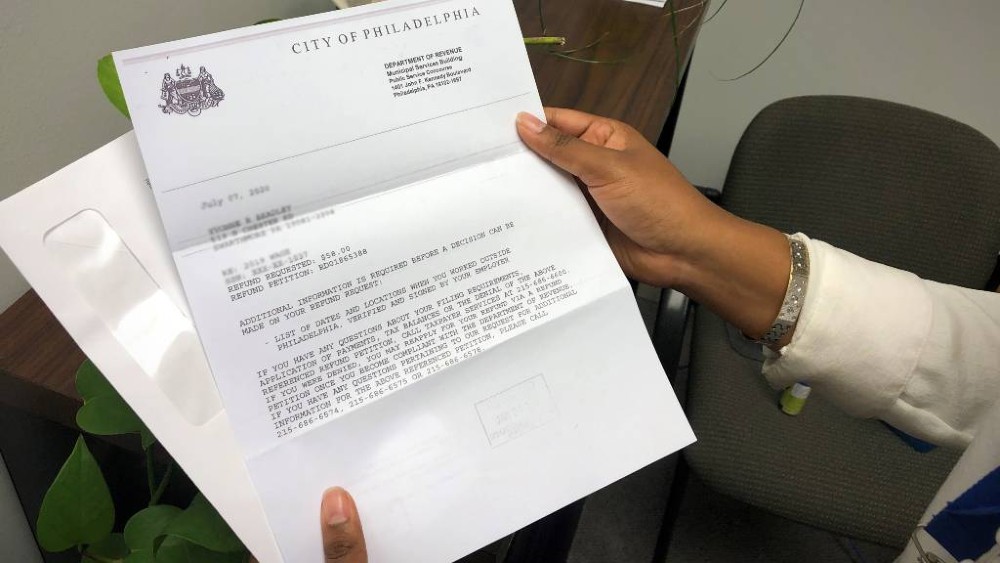

Why Was My Refund Request Denied Answers To Frequent Wage Tax Questions Department Of Revenue City Of Philadelphia

Philadelphia Real Estate Market Crunched By Low Home Supply And Price Inflation Will See The Return Of 10 000 Grants For First Time Buyers Phillyvoice

Philadelphia Revises Realty Transfer Tax Treatment Of Acquired Real Estate Companies

Philly Realty Transfer Tax What Is It And How Does It Work Department Of Revenue City Of Philadelphia

Philadelphia Real Estate Market Crunched By Low Home Supply And Price Inflation Will See The Return Of 10 000 Grants For First Time Buyers Phillyvoice